Automate lending processes

Capture, manage and securely store loan application information.

Streamline loan processes from origination to delivery to servicing.

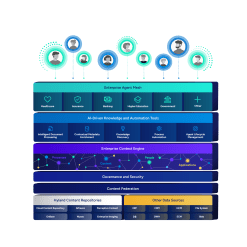

Harness the power of a unified content, process and application intelligence platform to unlock the value of enterprise content.

Learn more

Automate your document-centric processes with AI-powered document capture, separation, classification, extraction and enrichment.

Learn about Hyland IDPIt's your unique digital evolution … but you don't have to face it alone. We understand the landscape of your industry and the unique needs of the people you serve.

Overview of industries

Overview of industries

Countless teams and departments have transformed the way they work in accounting, HR, legal and more with Hyland solutions.

Overview of departments

Overview of departments

We are committed to helping you maximize your technology investment so you can best serve your customers.

Overview of services

Overview of services

You’re shaping the future, now it’s time to celebrate your achievements at CommunityLIVE 2026.

Submit your Hyland Innovation Award nomination!

Our exclusive partner programs combine our strengths with yours to create better experiences through content services.

Overview of partners

Join The Shift newsletter for the latest strategies and expert tips from industry leaders. Discover actionable steps to stay innovative.

Register now

Hyland connects your content and systems so you can forge stronger connections with the people who matter most.

Learn about HylandWith our modern, open and cloud-native platforms, you can build strong connections and keep evolving.

Dig deeper

Dig deeper

Position your organization for growth with next-generation content management and process automation solutions.

In today’s competitive environment, lenders need to deliver personalized experiences to build customer trust. Here’s how Hyland’s lending software can help.

Capture, manage and securely store loan application information.

Streamline loan processes from origination to delivery to servicing.

Securely deliver statements, escrow information and other documents through servicing portals.

Deploy web forms, case management and workflow software for account servicing and requests.

Hyland’s lending software automatically and securely uploads information to your e-signature solution.

Access an auditable history of a document’s complete journey and return to the integrated solution.

Deploy RPA bots for high-volume, repetitive tasks such as credit checks, employment verifications and more.

Assign tasks based on importance and urgency.

Route tasks and cases to workers with the knowledge, skills and time to complete them.

Hyland’s lending software solutions integrate with Black Knight, Encompass® and more so you can retrieve and view information seamlessly through your core loan origination and loan servicing systems.

Empower workers with up-to-date information for faster lending decisions and more informed customer engagements.

Future-ready bank deploys Hyland OnBase in the cloud to automate business processes, securely manage documents and empower employees.

Financial institution uses document tracking to support loan workflows from origination to servicing.

Bank automates and streamlines manual workflows by digitizing the loan payment process.

We have received your message and will be in contact shortly.

We have received your message and will be in contact shortly.