Top banking industry trends and challenges

There’s a lot that can keep bankers up at night. Factor in always-rising customer expectations, and the industry is often in need of technology solutions.

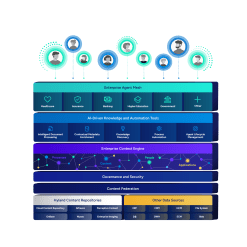

Harness the power of a unified content, process and application intelligence platform to unlock the value of enterprise content.

Learn more

Automate your document-centric processes with AI-powered document capture, separation, classification, extraction and enrichment.

Learn about Hyland IDPIt's your unique digital evolution … but you don't have to face it alone. We understand the landscape of your industry and the unique needs of the people you serve.

Overview of industries

Overview of industries

Countless teams and departments have transformed the way they work in accounting, HR, legal and more with Hyland solutions.

Overview of departments

Overview of departments

We are committed to helping you maximize your technology investment so you can best serve your customers.

Overview of services

Overview of services

You’re shaping the future, now it’s time to celebrate your achievements at CommunityLIVE 2026.

Nominate by March 27!

Our exclusive partner programs combine our strengths with yours to create better experiences through content services.

Overview of partners

Join The Shift newsletter for the latest strategies and expert tips from industry leaders. Discover actionable steps to stay innovative.

Register now

Hyland connects your content and systems so you can forge stronger connections with the people who matter most.

Learn about HylandWith our modern, open and cloud-native platforms, you can build strong connections and keep evolving.

Dig deeper

Dig deeper

Rising interest rates. The possibility of a recession. Credit quality and balance sheets.

There’s a lot that can keep bankers up at night. Factor in always-rising customer expectations, and the industry is often in need of technology solutions.

To get a better sense of where things stand at the start of the year, we turned to Chris Sims, Hyland’s Industry Consultant for Financial Services.

Chris has more than 20 years of experience in bank management, with a focus on mortgage lending, commercial lending and retail banking. At Hyland, Chris leverages that wealth of knowledge to help banks and credit unions address pain points and achieve their objectives.

We discussed top challenges and trends in the industry, the need for technology improvements, the importance of content services and much more.

Chris Sims: Hiring and retaining top talent, effectively managing information, acquiring and retaining customers — let’s just say there are a lot. Here are a few that really stand out to me:

Legacy content management platforms are creating silos, which slows the decision-making process, increases manual tasks and results in missing or incomplete data.

Customers expect fast and consistent omnichannel experiences. They are accustomed to great digital experiences — the Amazon effect — and demand the same of their bank and credit union.

The market is extremely competitive. Competitors are everywhere. Everyone from big box to retailers to small fintech companies are jumping into the banking space. And they’re bringing decision-making tools that get loans approved faster and more efficiently.

The Great Resignation, a competitive hiring environment and legacy systems that take up so much of the IT department’s time and budget are causing an increased lack of agility.

> Learn more | Bank delivers faster, more intuitive customer experiences with Hyland

Having a modern content services solution is crucial for many reasons. And it’s probably no surprise that customer habits are driving the need for change.

For the first time in four years, customer trust in banks is falling. In The US Banking Customer Experience Index Rankings, 2022, Forrester reported that trust in direct banks and multichannel banks fell two percentage points — to 62% and 61%, respectively, in 2022. This is a little bit of a concern and something that we need to pay attention to.

Mobile banking, to no one’s surprise, has surged since the start of the pandemic.

As more consumers prefer digital banking, ATM usage continues to decline. It’s down 38% year-over-year, according to Forrester. That number really jumps off the page.

Continuing with the digital-first theme, almost 3,000 branches closed in 2021, according to S&P Global Market Intelligence. That’s a 38% increase in one year.

Most banks don’t have time or resources to waste. They are turning to content services to bridge the gap and better prepare for the future.

Banks are at different stages of their digital journeys, and I expect content services to play a major role in how they react to the changing landscape.

A big one is RegTech, or regulatory technology. The rise in digital products has led to an increase in data breaches, cyber hacks and money laundering. RegTech tools can monitor transactions to prevent and eliminate some of these risks. RegTech is currently about a $5 billion to $6 billion market, and it’s expected to grow to about $19 billion by 2025. That’s incredible growth.

Another key is the digital evolution that is impacting every industry. Many of us have stopped carrying plastic and turned to more of an electronic wallet. Financial institutions are now jockeying to provide the best customer experience. They always want to stay one or two steps ahead instead of one or two moves behind.

Artificial intelligence is being used to streamline administrative processes and procedures to create more efficiency. Banks should evaluate their manual tasks and see which can be streamlined with automation.

> Learn more | Whitepaper: 8 key trends that are shaping the retail banking industry

CS: Many financial institutions are weighed down by manual procedures that create bottlenecks in their operations. Financial institutions need to utilize their IT staff to meet rapidly evolving customer expectations.

This will become even more vital as they begin to look at future product development. As banks and credit unions deal with a labor crisis and attempt to retain their staff, workload automation can reduce some of the pressure on employees and allow them to spend their time in areas that provide the most value.

By using automation, organizations will be less acutely impacted by the strained labor market, freeing financial institutions to innovate and serve customers without manual, repetitive tasks.

CS: Many times when I was sitting on the receiving end on the bank side, I would ask myself a few questions.

Can I justify this technology that’s being used?

Can I use it to streamline some of the processes or procedures that we currently have?

Is the technology agile enough to keep up with the ever-changing environment that’s happening right now?

And I can say, convincingly, that yes is the answer for all three of those questions — at least here at Hyland.

Content services platforms help banks unlock the value of their information through content and digital process automation solutions.

From new accounts to lending, compliance and the back office, modern content services bring efficiency, cost reductions and gains in customer and employee experience.

Learn more about Hyland’s solutions for banks and credit unions.

You might also like: