Hyper-personalization: The future of banking experiences

Hyper-personalized interactions are the building blocks of best-in-class customer experiences.

Hyper-personalized interactions are the building blocks of best-in-class customer experiences.

Consumer expectations are rising. They have acclimated to a level of service and experience that was only a dream for retailers a few years ago. It’s often referred to as the “Amazon effect.”

Today, consumers expect overnight or even same-day delivery of online shopping orders. Fast food delivery services know their favorite food orders and make suggestions based on them. The Starbucks store/app combination experience is impressive by any measure. (Any experience that allows consumers to feel good about spending $6 on a cup of coffee is pretty impressive!) Most consumers are experiencing highly personalized, tailored experiences adjusted to their preferences or behaviors from a merchant or app on their phone.

The question banking customers ask more and more often is: Why not my bank?

A hyper-personalized customer experience in every interaction can meet these expectations.

Hyper-personalization leverages data, analytics and custom interactions to meet individual customer needs and enhance satisfaction. Firms accomplish this by developing insights based on all available customer data and previous interactions and using the insights to create unique one-on-one experiences. Financial institutions must build the infrastructure to deliver unique experiences at the right place and time. This applies to all interactions — digital self-service, care centers and branches throughout the life cycle from marketing to collections, enabling financial institutions to predict customer needs — all in real time. This is not easy.

From the chart below, which is based on a recent Datos Insights study, it’s clear that consumers are asking for fast and convenient digital experiences. They will choose quick, easy digital experiences over lower costs: Consumers ranked rates and fees fifth against the other important factors when seeking a loan.

Good digital experience has been important for many years, but it’s now more than table stakes. Consumers in the Datos Insights survey had recently opened a savings account digitally 49% of the time. The study showed that 31% of consumers visited a branch when opening an account. The need for the branch is not going away, but the branch will need to evolve.

A successful digital capability serves the financial institution’s goals as well. The unassisted digital channel is fast and not prone to errors. It also represents the lowest cost of service compared to assisted channels. Bank of America announced in its Q2 2023 earnings call that it had achieved an 83% digital adoption rate. Its digital sales represented 51% of total sales. Achieving high rates of digital interaction will lower operating expenses and increase net promoter score. (If customers use it, it’s because they like it.)

Find out how American National Bank of Texas transformed its lending processes with an enterprise-wide set of solutions and cloud deployment.

Younger generations expect a high level of personalized service. The older generations like it when they receive it. The following chart presents consumer preferences of where they open a bank account by generation.

The older generations’ preferences regarding in-person vs. digital are as expected. The younger generations’ preferences also make sense until you reach the youngest group, Gen Z. One might expect they would have the greatest affinity for digital channels, as they know nothing but the current digital and, more specifically, mobile environment. As it turns out, some Gen Zers prefer to open accounts (maybe their first ones) in person and receive face-to-face advice from bankers. Millennials and Gen Xers choose digital at over twice the rate of Gen Zers.

Datos Insights expects Gen Z to be the most demanding when looking for a quality, personalized customer experience. However, they may be looking for it in the branch.

When Datos Insights asked U.S. consumers what is most important to them when selecting their primary financial institution, a resounding 89% responded that trust was very or extremely important. Trust is a quaint concept from days gone by. Or is it?

When consumers are asked what is most important when choosing a financial institution for a specific product (e.g., a loan, checking accounts), they responded with speed, convenience and simplicity. This question is different than “Whom do you trust with your life savings?” Are challenger banks, fintechs and other new market entrants on a path to trusted financial advisor status? Probably not. It takes more than a cool website and good rates to fill this role for consumers. However, traditional banks and credit unions are well-positioned to do so.

The study also found that consumers rank “innovative and cutting edge” a distant fifth in importance (24%) when choosing a financial services partner.

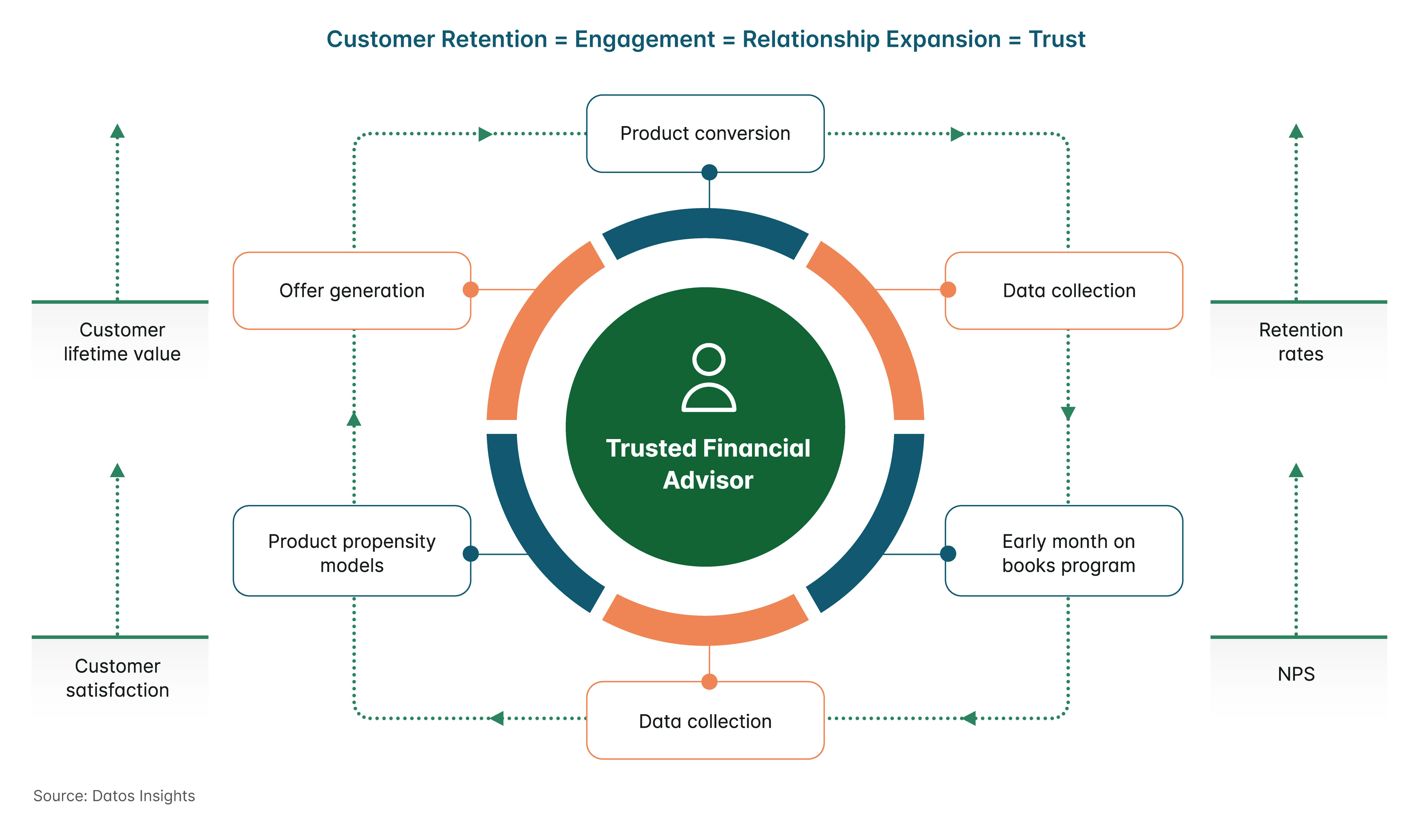

A superior customer experience is necessary to deliver these promises. A virtuous cycle is established when consumers feel their financial services needs are met, the offers make sense for them and arrive at the right time, and they receive advice that matches their life stages and household situation. In addition, consumers want to be occasionally reminded that their accounts and privacy are safe and that their financial institution will stand by them when fraud or data breaches do occur. Financial institutions can offer these experiences via digital or branch channels.

Moreover, achieving the state of a trusted financial advisor is a sustainable competitive advantage. This is not a strategy that challenger banks can easily adopt. Their product and service capabilities are generally too narrow, human interaction is usually not an option and they have not generally been building their brands on trust.

Financial institutions must build competencies around capturing and managing data and content to provide the experiences consumers expect. The data spinning off various legacy platforms, from transactions to mobile app logins and managed documents, will all need to be managed in a way that allows for the development of actionable insights. These insights, and how they are used to build custom interactions, will become the new secret sauce by which financial institutions will distinguish themselves.

Hyland accelerates digital initiatives for banks by unlocking the value of content — inside and outside of core systems.

---

Stewart Watterson is a Strategic Advisor in the Retail Banking & Payments practice at Datos Insights. He brings a broad range of experience from 30 years of consumer banking with Chase, National City and PNC, serving as SVP, Mobile Wallet & Emerging Payments.

Explore the essentials of ECM, its benefits and how it transforms content management to enhance efficiency and compliance in your organization.

Cloud data security is a top priority for any cloud-enabled organization. Proper execution requires cloud expertise, organizational behavioral training and continual digital transformation of the technology stack and strategy.

Managing your assets in the cloud keeps you well positioned to meet the growing demands for content.